Malaysia Cars Loan Instalment Payment

If the fresh grad is to put a downpayment of 10 and take a five-year loan with an estimated interest rate of 3 they would be paying roughly RM404 per month RM303 for a seven-year loan or RM247 for a nine-year loan. In total you will be paying back roughly RM36300 over 7 years given that your rates have not changed.

How To Get Your Car Loan Approved Here Are 5 Things That Affect Your Chances Wapcar

Pay no instalments for 15 months receive ECO steriliser worth RM1200.

. You have a hire purchase loan of RM30000 at 3 flat pa. Please add payments for any other charges eg. So you got save up 4k.

Ad Our service may be boring but its easy free and could save you a lot of money. AmBank Arif Hire Purchase-i. What Determines Your Car Loan Instalments And Interest Payments.

Down payments can also be paid by trading in your current vehicle. Buying a new or used car has never been easier with our Auto Financing HP-i. Naturally due to principles of the loan the bank has the right to repossess the vehicle if one fails to pay the instalments accordingly.

So register with us today. HSBC Bank HSBC Amanah Malaysia Berhad Image via New Straits Times. Terms and conditions apply.

Apply with bank ID. Alliance Bank Hire Purchase. Equivalent Mortgage FD Interest Rate saved by full settlement is.

For Malaysian you got save for 4K is a big money yahh. Otomy is the best way to buy and sell new used and reconditioned cars in Malaysia. Learn More Apply Now.

You may find several dealerships promoting a down-payment of as low as RM500 for a new car but that may mean a higher monthly payment andor longer repayment term. Visit our office for a chat. In this article well show you how it works and how to calculate your monthly instalment for a conventional car loan in Malaysia.

Ad Our service may be boring but its easy free and could save you a lot of money. Insurance and road tax. Hong Leong Auto Loan.

Bank Muamalat Hire Purchase-i. Hence COVID19 We are open for business sell your car from home. Use this calculator to find out your settlement and rebate amount if you want to pay off your car loan or personal loan early.

For those who do not know Bank Negara Malaysia BNM granted a moratorium on loan repayments including hire purchase or more commonly known as car loans for 6 months from the 1st April to 31st September 2020. 603-7626 8899 Website 11. Needless to say paying for your car in cash is never ideal in any situation for several reasons.

For 7 years that would mean 84 monthly instalments. The total amount that you must pay if you regularly pay for 9 years are 42K base on car interest loan at 4 annually. So your car loan balance total are 24K.

A minimum of 10 down payment is usually required by banks for the purchase of a brand-new car and about 20 for a used car. Insurance or Takaful coverage. Things you should know about hire purchase loans in Malaysia.

Restructuring and rescheduling of instalment repayments Special Relief Facility for SMEs affected by COVID-19 Priority Lane for those customers who apply for these plans Contact Centre. Overdue interest or compensation fees with your. Its simple free and easy.

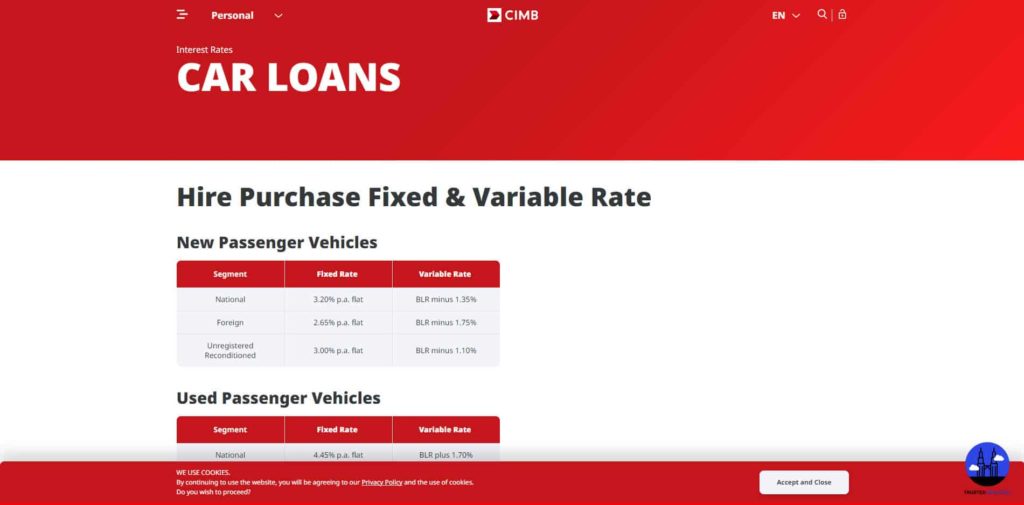

Car Loan Interest Rates. 15 October 2021 to 31 December 2021. Apply with bank ID.

Active for 30 days. 18 20 depending on loan package Maximum Age. For an example if youre paying RM1000 per month for your existing car loan which is due to end by say June 2021 you will continue to pay the same amount RM1000 per month from October.

Purchase the family-friendly SUV today with Maybank Car Loan. This is done to relieve those who are going through temporal financial constraints during these unprecedented times. Find a branch NEWS PROMOTIONS View all news.

Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network. Enjoy instalment period up to 108 months. Apply for free now.

Total interest over loan period. Payment will be automatically debited from your account on a fixed schedule every month. Car Loans - Monthly Installment Calculator Monthly Installment Calculator Call Us Anytime We are contactable 247 603 6204 7788 Visit Us Prefer to meet us in person.

Active for 30 days. 2020-07-22 - TAKING up a car loan also known as a hire purchase loan is the most common approach to buying a car. Public Bank Aitab Hire Purchase-i.

Apply for free now. CIMB now offers you a Car Loan Monthly Installment Calculator. Do you know if TODAY you want to pay full settlement you only pay for 20K instead of 24K.

Your total interest charge will be 3 x RM30000 x 84 months RM6300. Alternatively you may walk in to any of our branches to make payment. Drive confidently and enjoy safer journeys with over 100 safety features.

44 70 depending on loan package If youre looking for specific loan packages that fit your needs you should check out the vehicle financing options that Bank Muamalat offers. Car loans commonly offer a maximum margin of financing of 90 hence you are expected to pay 10 of the car value to the dealership. Drive now pay later with Subaru Forester.

We finance a wide range of car brands. Or find your next car amongst the quality listings at otomy. Check out our up-to-date Personal Loan comparison tool.

In general you have to pay about 10 of the value of the new car you are purchasing or 20 for used cars. Some car buyers prefer to pay a higher down payment to reduce the interest paid while some prefer to have more cash in hand. Payments via M2U for Hire Purchase or AITAB - iecar loanfinancing must be in complete instalment amount.

Enjoy up to 90 financing for qualified customers only. Find out how you can afford you can pay off your dream car before you even buy it.

5 Banks That Offer The Best Car Loan In Malaysia 2022

Should You Pay Back Your Car Loan Early

Comments

Post a Comment